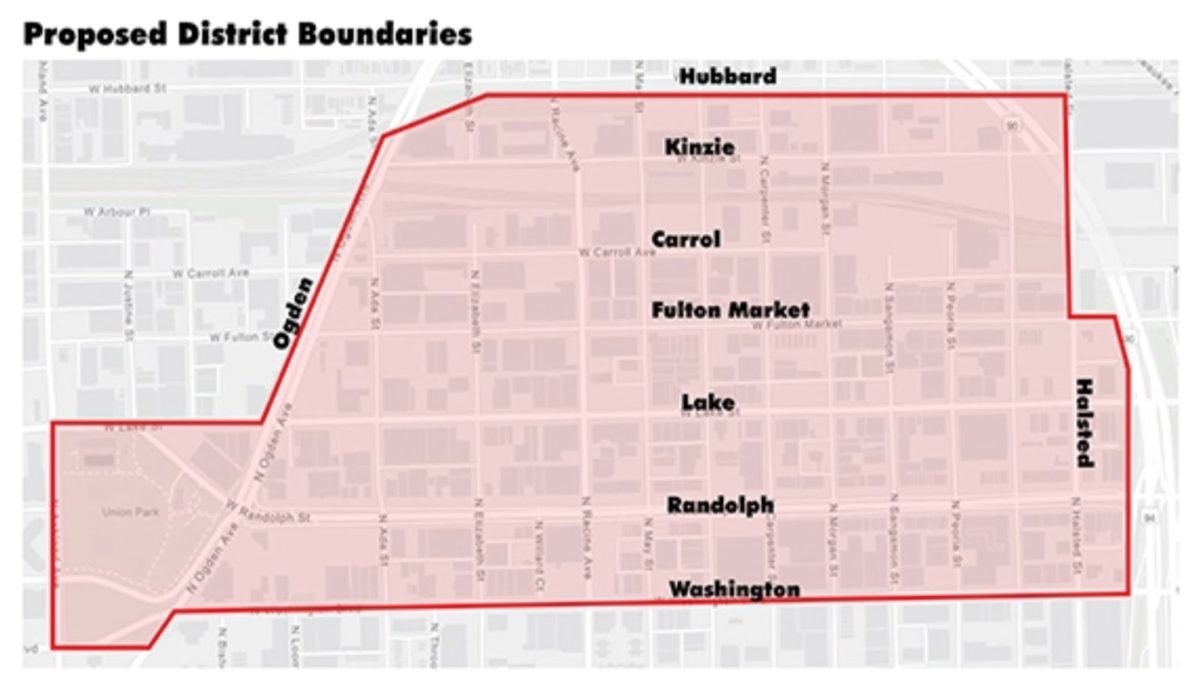

A Special Service Areas (SSAs) is being proposed for the portion of Fulton Market pictured below. SSAs are local tax districts that fund services and programs to augment those provided by the City through a localized tax of property owners.

About SSAs

Known as Business Improvement Districts or BIDs in other cities, the first SSA was established in Toronto in 1970 by a group of local businesses. The concept has since spread to the U.S. and other countries around the world. SSAs are usually started by commercial interests that desire more services that their local municipality provides.

The Illinois General Assembly passed the Special Services Area Tax Act in 1973 to allow for localized SSA taxing. This legislation was repealed and replaced with the Special Services Tax Law in 1994. The law requires a process to implement an SSA, starting with public hearings that outline details of the SSA like the proposed tax rate and duration, a petition period, and the filing of documents with the county clerk.

In Chicago, the City contracts with local non-profits, called service providers, to manage SSAs. Mayorally-appointed SSA Commissioners for each SSA district oversee and recommend the annual services, budget and Service Provider Agency to the City. The large majority of service providers for the city’s 55 SSAs are chambers of commerce or other organizations focused on business development. It is assumed that West Loop Community Organization (WLCO) would be the service provider for a Fulton Market SSA, but this has not yet been stated officially.

SSA taxes are based on the equalized assessed value (EAV) of property within the defined (non-exempt) SSA area. For example, a 0.1% tax on $100,000 would result in a $100 annual payment. SSA-funded projects typically include but are not limited to: public way maintenance and beautification; district marketing and advertising; business retention/attraction, special events and promotional activities; auto and bike transit; security; façade improvements; and other commercial and economic development initiatives.

SSA Examples

The West Loop already has an SSA in Greektown. SSA #16 is administered by the West Central Association (WCA), the chamber of commerce for much of the West Side. The SSA assesses a tax of up to 1.0% for properties within a boundary runs along Halsted from Van Buren to Madison. The tax funds a number of initiatives, including cleaning of sidewalks, holiday decorations, maintenance of monuments, public art, marketing & advertising, special events, landscaping, trolley service to the United Center, and strategic planning.

Chinatown implemented SSA #73 in 2018 with the Chicago Chinatown Chamber of Commerce serving as the service provider. The first year tax rate for SSA #73 was 0.31% (the overall cap is 0.8%). All but one of the properties in the boundary area are commercial (out of 263 total) – see the map below. Note that portions of the SSA boundary are exempt from the tax but would still benefit from its programs. Note also that the Chinatown SSA boundary overlaps a tax increment financing (TIF) district, which would also be the case in Fulton Market.

Community Input

WLCO has created a survey to assess the priorities for Fulton Market. All residents are encouraged to complete this survey and to attend one of two community meetings for the proposed SSA being held this week at Revel, 1215 W. Fulton Market:

- Tuesday, May 28 at 9 am

- Wednesday, May 29 at 6 pm

Be sure to bring your questions to these meetings as they will help to determine if a Fulton Market SSA is created and what form it takes. Here are a few questions we hope to have answered by those leading the SSA process:

- Who petitioned for the creation of an SSA in Fulton Market?

- What would the maximum tax rate be?

- How long would the SSA be in place?

- What non-profit organization will be the service provider?

- Will residential properties in the SSA boundary be exempted from the tax?

By: NoWL President, Matt Letourneau

Date: May 27, 2019